Global Water Soluble Polymer Market Analysis (2024–2032)

Market Overview

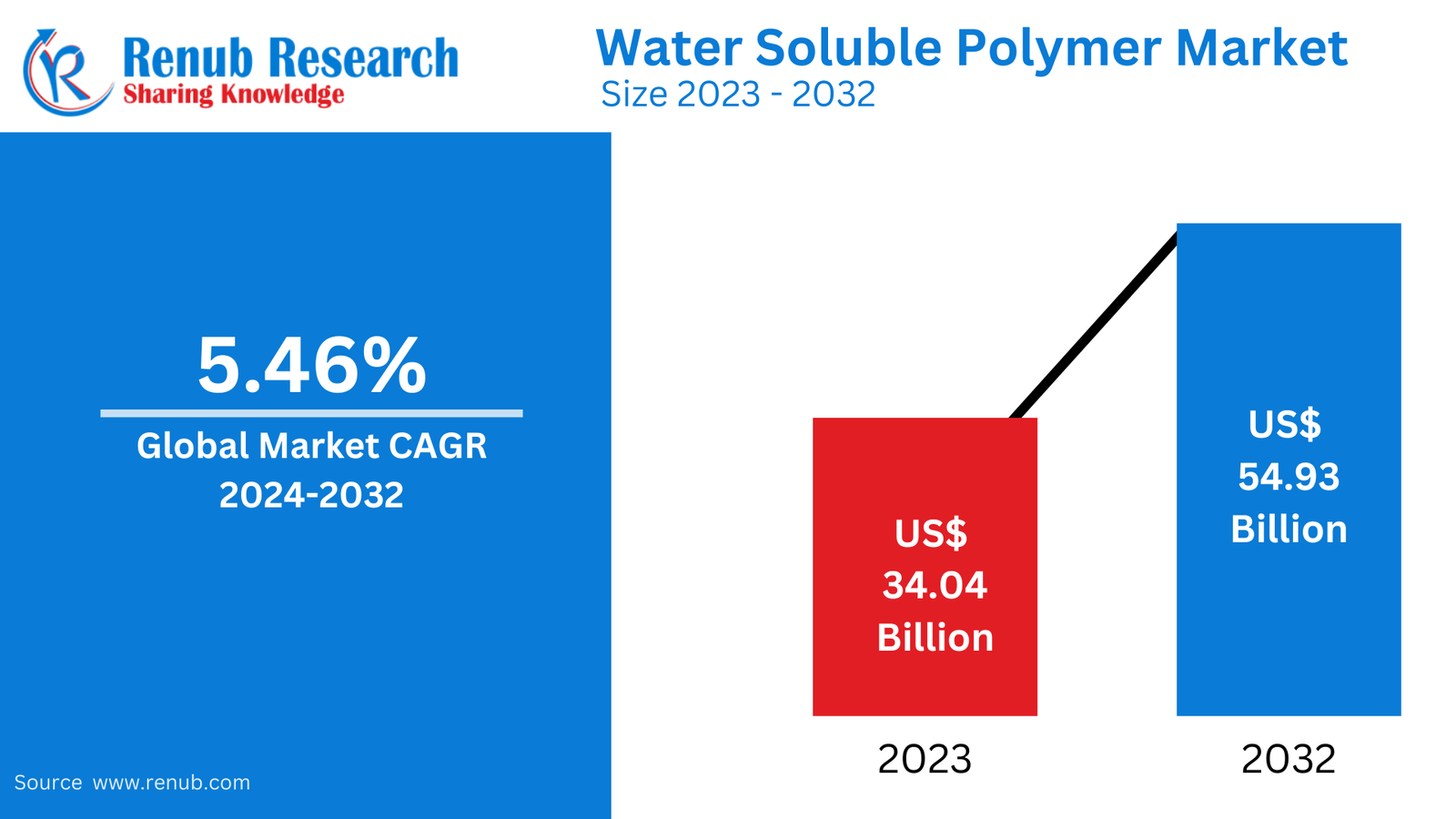

The Global Water Soluble Polymer Market is projected to reach US$ 54.93 Billion by 2032, up from US$ 34.04 Billion in 2023, growing at a CAGR of 5.46% during 2024–2032. Growth is fueled by rising demand across pharmaceuticals, food & beverages, and personal care industries, alongside increasing environmental regulations and sustainable packaging initiatives.

What are Water Soluble Polymers?

Water soluble polymers are organic compounds that disperse, dissolve, or swell in water, altering the physical properties of aqueous systems via thickening, gelation, or emulsification. Key functions include:

- Lubricants

- Coagulants and flocculants

- Film-formers

- Humectants and thickeners

- Suspending and binding agents

Key Market Drivers

📌 1. Rising Pharmaceutical Applications

- Improves drug solubility, stability, and bioavailability

- Widely used in controlled-release systems

- Essential in tablet and capsule formulation (binders, stabilizers)

- Rising drug innovations and aging population push market growth

📌 2. Sustainable Packaging Demand

- Increasing preference for eco-friendly packaging

- Materials like polyvinyl alcohol (PVA) & polyethylene oxide (PEO) meet environmental standards

- Utilized in agricultural films and single-use packaging

- Drives demand in food & personal care sectors aiming to enhance green branding

📌 3. Technological Innovations

- Developments in polymer chemistry for enhanced performance

- Emerging techniques: nano-encapsulation, 3D printing, composite blends

- Enables customized solutions across pharma, food, and personal care

Related Report

Asia Pacific: The Leading Regional Market

Rapid industrialization and economic growth in China, India, Southeast Asia, and Japan significantly boost demand. Key factors include:

- Agriculture: Use of polymers for water retention, soil conditioning, and erosion control

- Construction: Use in cementitious systems, mortars, and grouts

- Government data show:

- Indonesia: Palm oil production rose to 45.58 million metric tons in 2022 (from 34.94 in 2017)

- Philippines: Corn production reached 8.26 million metric tons in 2022

- Japan: Construction investment hit USD 0.47 trillion in 2023

Market Segmentation

By Type

- Polyacrylamide

- Polyvinyl Alcohol

- Guar Gum

- Gelatin

- Xanthan Gum

- Polyacrylic Acid

- Polyethylene Glycol

- Others

By End Use

- Water Treatment

- Food

- Personal Care & Detergents

- Oil & Gas

- Pulp & Paper

- Pharmaceuticals

- Others

By Region

1. North America

- United States

- Canada

2. Europe

- France, Germany, Italy, Spain, UK, Belgium, Netherlands, Turkey

3. Asia Pacific

- China, Japan, India, Australia, South Korea, Thailand, Malaysia, Indonesia, New Zealand

4. Latin America

- Brazil, Mexico, Argentina

5. Middle East & Africa

- South Africa, Saudi Arabia, UAE

Key Companies Analyzed

- Arkema

- Ashland Inc

- BASF SE

- DuPont de Nemours, Inc.

- Kemira Oyj

- Kuraray Co Ltd

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- Nouryon

- Sumitomo Seika Chemicals Co. Ltd

Company Analysis Includes:

- Business Overview

- Key Executives

- Recent Developments

- Financial Insights

Recent Industry Developments

- Jan 2024 – SNF Group invested USD 250 Million to expand production in Oman and set up a new R&D center in Muscat.

- Aug 2022 – BASF collaborated with Nippon Paint China to launch eco-friendly industrial packaging using Joncryl HPB.

- Feb 2022 – Kemira Oyj initiated biomass-based polyacrylamide production; first commercial use by HSY in Finland.

Report Specifications

| Feature | Details |

| Base Year | 2023 |

| Forecast Period | 2024 – 2032 |

| Market Size (2023) | US$ 34.04 Billion |

| Market Size (2032) | US$ 54.93 Billion |

| CAGR (2024–2032) | 5.46% |

| Format Available | PDF, Excel (editable PPT/Word on request) |

| Post-sale Support | 1 Year |

| Free Customization | 20% |

Customization Services

- Country & segment-specific expansion

- Up to 10 additional company profiles

- Trade, production, and entry strategy insights

- Tailored regional market dynamics